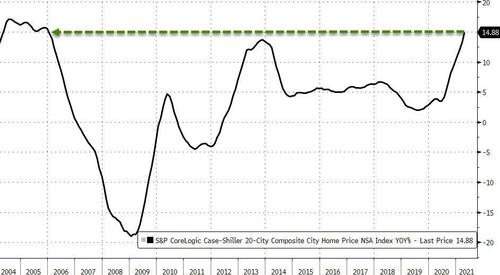

According to the Case-Shiller indices, home prices in America’s 20 largest cities have exploded at 14.88% YoY in April – the highest since Nov 2005…

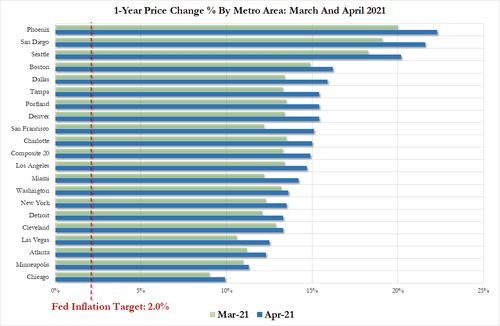

Phoenix, San Diego, Seattle reported highest year-over-year gains among 20 cities surveyed…

All cities are seeing home prices appreciate at double digits (a little higher than The Fed’s 2% “goal”).

“April’s performance was truly extraordinary,” said Craig J. Lazzara, global head of index investment strategy at S&P Dow Jones Indices.

But, on a national scale, it gets even worse. Case-Shiller’s National Home Price Index rose 14.59% YoY in April – that is the fastest pace of home price inflation on record (back to 1988)

That is faster than the prior peak acceleration in September 2005!

“We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes,” Lazzara added.

“April’s data continue to be consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing.”

The question for Jay Powell is – explain how this is “transitory” if you’re never gonna taper or hike rates?

“The forces that have propelled home price growth to new highs over the past year remain in place and are offering little evidence of abating,” Matthew Speakman, and economist at Zillow Group Inc., said in a statement.

“The number of available homes for sale remains historically small, particularly given the elevated demand for housing.”

Republished from ZeroHedge.com with permission

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.