Bitcoin has soared back above $48,000 this morning, after crashing near a $42,000 handle over the weekend, following Congress’ passing of Biden’s stimulus package.

“In the US a $1.9 trillion stimulus package is on the way. That’s more than all the cash currently sitting on the US Treasury account at the Federal Reserve,” on-chain analytics service Ecoinometrics summarized to Twitter followers.

“This is good for Bitcoin.”

However, perhaps most notably, in a 108-page deep-dive into cryptocurrencies, Citi said there had been a major change in bitcoin from “primarily a retail-focused endeavor to something that looks attractive for institutional investors” as they search for higher returns and alternative assets.

“The entrance of institutional investors has sparked confidence in cryptocurrency but there are still persistent issues that could limit widespread adoption,” Citi said.

Additionally, Citi says Bitcoin could be at the start of a “massive transformation” into the mainstream of finance and could even become the currency of global trade.

“Bitcoin’s future is thus still uncertain, but developments in the near term are likely to prove decisive as the currency balances at the tipping point of mainstream acceptance or a speculative implosion.”

They also warned that improvements to cryptocurrency systems would be needed to drive wider adoption, and said increased regulation could drive away some of the most innovative players.

Citi analysts concluded, “There are a host of risks and obstacles that stand in the way of Bitcoin progress. But weighing these potential hurdles against the opportunities leads to the conclusion that Bitcoin is at a tipping point.”

Read the full report here.

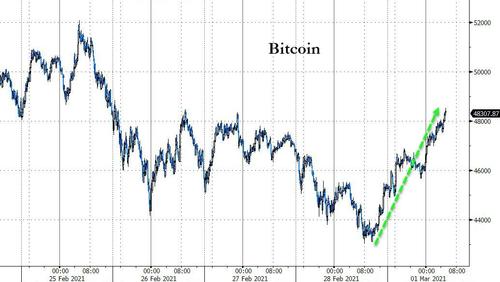

All of which lifted bitcoin significantly overnight…

Source: Bloomberg

“The panic of yesterday was so unnecessary. Welcome to the markets, dips happen. Part of the game,” Cointelegraph Markets analyst Michaël van de Poppe wrote on Monday.

“We just continue grinding and Bitcoin is just starting. Relax.”

MicroStrategy reportedly bought the dip, adding another 328 bitcoin for about $15 million in cash, swelling its holdings of the cryptocurrency and sending the company’s shares 7% higher in premarket trading.

The world’s largest publicly-traded business intelligence company now owns close to 90,859 bitcoin, which were acquired at an aggregate purchase price of about $2.19 billion and an average purchase price of around $24,063 per bitcoin, it said on Monday.

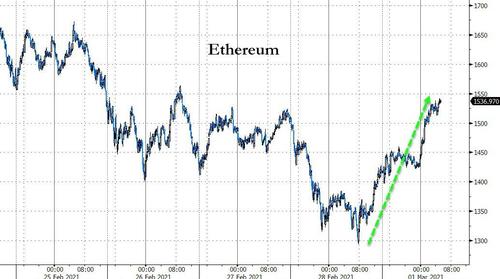

Additionally, Ethereum has ripped back near $1550 (after hitting a $1200 handle briefly over the weekend), helped by broad flows and positive comments from billionaire Mark Cuban.

Source: Bloomberg

In an extensive interview with Decrypt, the billionaire “Shark Tank” shark and owner of the Dallas Mavericks says Ethereum smart contracts will spell big trouble for big SaaS (software as a service) companies.

The “simplification of smart contracts” on the Ethereum blockchain, Cuban said, is “what gets me excited. Because now, all these SaaS companies, all these different companies, I could see just disrupting the f–k out of them. I mean, it’s just like, imagine an accounting system where you have trained accountants that you pay as accountants, and there’s, you know, thirty, forty validators around the world that are validating, and when I say pay, you pay them in tokens… And now, they look at a general ledger entry, and they all have to have consensus on the general ledger entry, and they don’t know each other. There’d be no Enrons. You wouldn’t have the level of fraud that you have now.”

Cuban, who recently said he bought some Bitcoin through Coinbase years ago and simply didn’t talk about it publicly, has now made clear he sees more exciting potential in Ethereum than Bitcoin.

“Bitcoin is kind of stuck with store of value, even though there is a blockchain there,” Cuban told Decrypt.

“That’s more just for confirming transactions that take place, you know, with Bitcoin buying and selling, where now with Ethereum, with smart contracts, you know, I’m teaching myself Solidity right now, it’s not hard if you’ve done any programming languages… And so now you can start to see, and I started to see, the simplicity of creating smart contracts that are then stored in full on the blockchain, which are then immutable, right, and now you can start seeing what other things can happen with this.”

None of that is to say that Cuban doesn’t believe in Bitcoin as an investment. He says Bitcoin is “better than gold,” and adds that, “whether it’s Bitcoin or Ethereum, or even maybe some other choices, when somebody owns that, they become their own personal banker.”

Watch the full interview here.

Not everyone is so bullish. Michael “Big Short” Burry took to Twitter to warn:

“$BTC is a speculative bubble that poses more risk than opportunity despite most of the proponents being correct in their arguments for why it is relevant at this point in history,” the investor wrote before deleting the tweet as usual.

“If you do not know how much leverage is involved in the run-up, you may not know enough to own it,” he added.

Burry specifically warned:

“Fads today (#BTC, #EV, SAAS #memestocks) are like housing in 2007 and fiber/.com/comm/routers in 1999,” he said.

“Those saying me and Munger and Singer are so out of touch are not considering that we have seen this all before, and not just once,” he said, referring to recent warnings about market speculation from Berkshire’s Charlie Munger and hedge-fund billionaire Paul Singer.

“The market is dancing on a knife’s edge.”

Finally, Third Point’s Dan Loeb got rather cerebral on cryptocurrencies, but did seem to come down more on the positive side than negative:

I’ve been doing a deep dive into crypto lately. It is a real test of being intellectually open to new and controversial ideas. Culturally I compare bridging the crypto world with the old as akin to finding a portal @chbetween two distinct worlds in the multiverse.

Also, maintaining healthy skepticism while also deepening one’s understanding requires one to engage in what Steve Jobs (and Fitzgerald before him) described as requisite for a superior intellect: “to maintain two opposed ideas in ones mind and retain the ability to function“

Another conflict to overcome is the idea that being late to the crypto party will inevitably lead to one taking the sucker seat at a high stakes poker table versus this still being early days in what is just now being adopted in the mainstream.

We give the last word to Citi, who seem much less conflicted than Loeb: “Bitcoin is becoming the de facto ‘North Star’ of the digital asset space, with its trajectory being seen as a compass for the evolution of the broader ecosystem.”

Republished from ZeroHedge.com with permission

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.