Update 1103 EST: Everyone seems to be piling on Robinhood, including hip hop artist and Fyre Festival bankroller Ja Rule, who says “this is a fucking CRIME” about the measures Robinhood is taking.

Yo this is a fucking CRIME what @RobinhoodApp is doing DO NOT SELL!!! HOLD THE LINE… WTF ?

— Ja Rule (@jarule) January 28, 2021

Update 1017 EST: Bloomberg is reporting that the SEC and Fed will likely take “little action” over the trading in GameStop and other names – but that it may include a trading suspension in the names.

Analysts told BBG: “We do not believe the SEC will issue an emergency order nor will the Fed change margin requirements. The only possible action that will potentially be taken is the SEC suspending trading in one or more of the names for one to two business days”

Update 0950 EST: Robinhood (once again) appears to be down. There’s no word on whether the disruption is just from the volatility or whether or not it is directly related to the platform’s ban of buying certain equities:

ROBINHOOD SAYS ISSUES WITH EQUITIES, OPTIONS, CRYPTO TRADING

ROBINHOOD SAYS DISRUPTION WITH IOS, ANDROID AND WEB APP

ROBINHOOD SAYS EXPERIENCING SERVICE DISRUPTION

Update 0925 EST: Interactive Brokers has joined Robinhood and has put option trading in some names into liquidation. This headline crossed the terminal around 0925EST:

INTERACTIVE BROKERS PUTS SOME OPTION TRADING INTO LIQUIDATION

In a statement to CNBC, IB said:

“As of midday yesterday, (1/27/2021) Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets. In addition, long stock positions will require 100% margin and short stock positions will require 300% margin until further notice. We do not believe this situation will subside until the exchanges and regulators halt or put certain symbols into liquidation only. We will continue to monitor market conditions and may add or remove symbols as may be warranted.”

Additionally, Robinhood has released the following statement:

“We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK. We also raised margin requirements for certain securities.”

We can’t help but wonder…

Dear free and efficient markets, is there a restricted list for stocks that anyone without a Hampton's mansion can no longer trade?

— zerohedge (@zerohedge) January 28, 2021

Update 0842 EST: Barstool Sports’ Dave Portnoy has weighed in on the restriction, stating “Either @RobinhoodApp allows free trading or it’s the end of Robinhood. Period.

Either @RobinhoodApp allows free trading or it’s the end of Robinhood. Period.

— Dave Portnoy (@stoolpresidente) January 28, 2021

He has also Tweeted: “And it turns out @RobinhoodApp is the biggest frauds of them all. “Democratizing finance for all” except when we manipulate the market cause too many ordinary people are getting rich.”

He continued: “Somebody is going to have to explain to me in what world [Robinhood] and others literally trying to force a crash by closing the open market is fair? They should all be in jail.”

Somebody is going to have to explain to me in what world @RobinhoodApp and others literally trying to force a crash by closing the open market is fair? They should all be in jail.

— Dave Portnoy (@stoolpresidente) January 28, 2021

Ameritrade I expect. @RobinhoodApp entire business model is to cater to the exact people they are now trying to fuck with and scare into selling. They will never recover from this.

— Dave Portnoy (@stoolpresidente) January 28, 2021

**

One day after TD Ameritrade implemented unprecedented restrictions on trading in GME, AMC and other massive short squeezes, on Thursday morning reports are circulating on social media that Robinhood is no longer allowing GameStop or AMC share purchases.

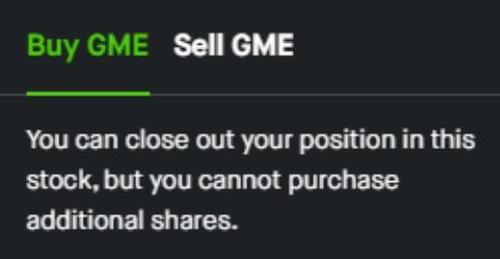

“Robinhood Removes GameStop, AMC; Puts Notice On Pages Saying ‘You Can Close Out Your Position On This Stock, But You Can Not Purchase Additional Shares’,” Benzinga reported at about 0830 EST.

The report was corroborated by additional sources shortly after 0830 EST.

Ok seems like it's true from the numerous #Robinhood traders that have confirmed they cannot trade #GameStop #AMC or #Express on their accounts right now$gme$amc$exp https://t.co/CRbu1fCofr

— Susan Li (@SusanLiTV) January 28, 2021

Users are reporting the same on Twitter.

— Derek Ross (@derekmross) January 28, 2021

There are also scattered reports that the app has restricted BlackBerry. Users on social media are furious:

In case it wasn't obvious yet, they'll do anything to prevent retail from making lots of money in the stock market. Robinhood just proved this by removing $GME, $AMC and more.

— Michael Handschuh (@mhandschuh) January 28, 2021

Is @RobinhoodApp really blocking $GME sales so these fucking hedge funds can cover their short? Disgusting

— Maeds (@Themaeds) January 28, 2021

Funny to see @RobinhoodApp promoting Finance Democracy whilst blocking people who are exactly exercising finance democracy from buying $GME, $AMC and $NOK. pic.twitter.com/fjkDcupZxT

— Derek ????? (@derekhkwok) January 28, 2021

Republished from ZeroHedge.com with permission

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.