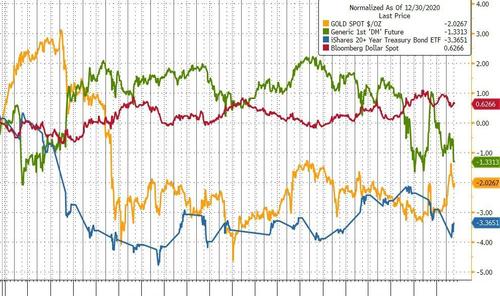

The USDollar managed to end higher for the month of January while stocks, bonds, and gold all ended lower…

Source: Bloomberg

Cryptos, however, had a big month, led by Ethereum (and helped the last few days by a migration of WSB’rs and Elon Musk)…

Source: Bloomberg

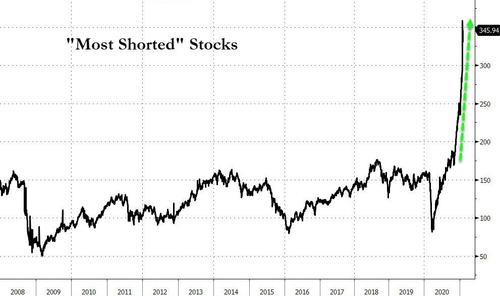

Of course, the really big news was the ‘Reddit Rebellion’ that routed shorts late in the month, pushing “Most Shorted” stocks to their biggest monthly squeeze in history…

Source: Bloomberg

With the Top 10 most-heavily shorted stocks in the Russell 3000 utterly exploding…

Source: Bloomberg

This is madness… Those are month-to-date %age performance numbers! lol

Source: Bloomberg

Small Cap stocks surged in January (where many of the ‘most-shorted’ stocks are found) as Dow and S&P were flat and Nasdaq managed only modest gains…

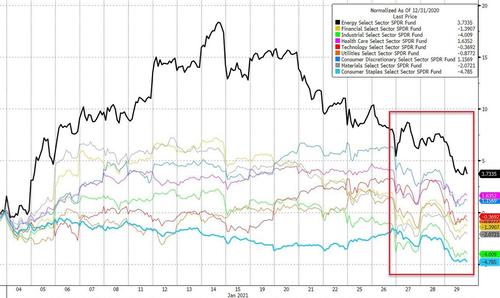

Energy outperformed in January, Staples were worst but everything was hit in the last few days…

This week was the worst for stocks since October…

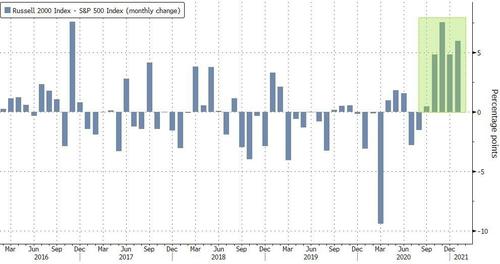

The Russell 2000 outperformed the S&P 500 for the 5th straight month…

Source: Bloomberg

This week’s weakness sent The Dow back below its 50DMA…

And The S&P 500 found support at its 50DMA…

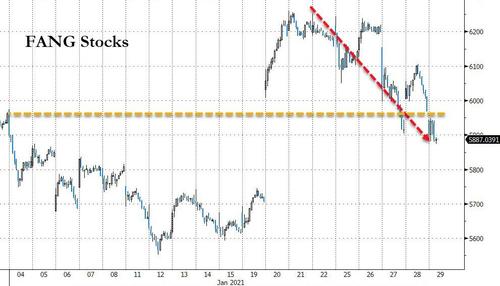

And as shorts suffered, hedgies were forced to liquidate many of their most liquid longs…

Source: Bloomberg

…pushing FANG stocks back to unchanged on the month…

WSB to Hedgies…

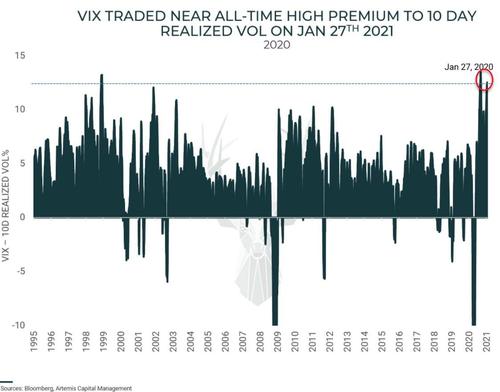

Artemis’ Christopher Cole points out that VIX traded at all-time highs to realized January 27th (Vol-of-vol also near an all-time high amid the transmutation of solvency risk for select L/S HF and margin calls on brokers such as Robinhood)

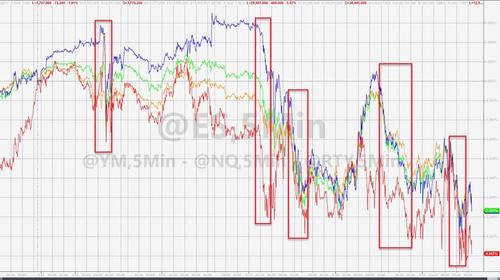

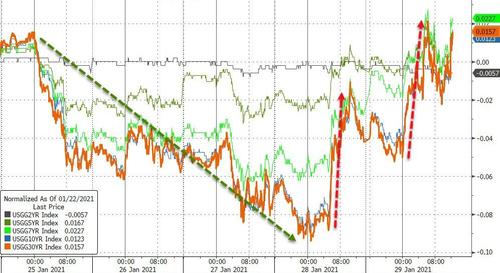

Bonds were notably sold in the last two days – even as stocks puked – suggesting a sell everything liquidation…

Source: Bloomberg

On the month, the short-end was unch as the long-end steepened notably…

Source: Bloomberg

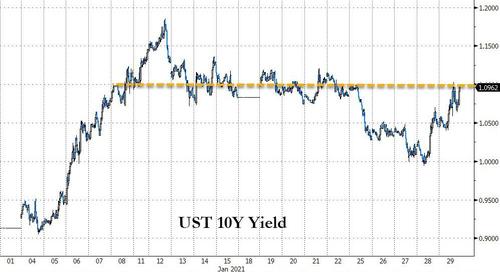

1.10% remains a key level for 10Y yields…

Source: Bloomberg

Real Yields tumbled in the back half of January…

Credit: Bloomberg

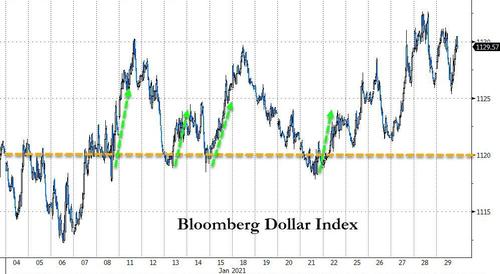

The dollar was up on the month – its first monthly gain since September.

Source: Bloomberg

Bitcoin tested back above $38k today after Elon Musk’s tweet…

Source: Bloomberg

Notably, precious metals got a boost in the last week as the WSB crowd shifted their attention to miners…

Silver surged…

And so did Gold, but each surge in gold was met by a mysterious selling pressure…

And so did Gold, but each surge in gold was met by a mysterious selling pressure…

And crude futures were totally insane…

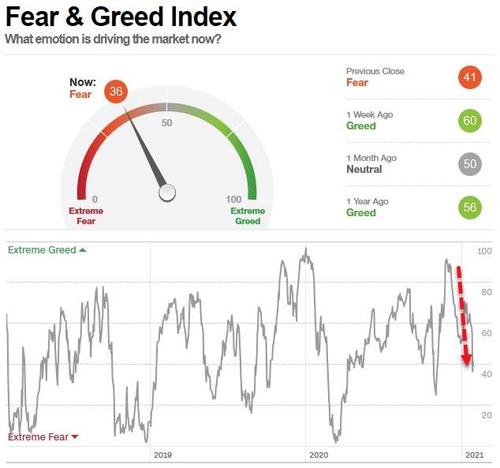

Finally, this made us laugh out loud – The Fear & Greed Indicator has plunged to 36, full of fear!

And the S&P 500 is just 3.5% from all-time record high prices (and valuations).

Republished from ZeroHedge.com with permission

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.