With a victorious vote out of the European Union, Brexit has caused the sterling pound to collapse to lows as low as 1985 as U.K. stock futures plunge something that we previous warned about a month ago. That Brexit could cause the Sterling and EU to collapse.

George Soros also warned that a YES vote to leave the EU would cause a currency crisis and he invested his money into gold.

As a result of Brexit, Gold and the YEN has also surged in value, Gold jumped 8.1 percent or $1,358.54 an ounce. Soros just made off like a bandit.

while the Euro slumped 3.3 percent and other countries currency markets around the world plunged even worse.

An expert in Asia John Woods, chief investment officer for Credit Suisse Private Banking said.

“It’s highly likely that we see monetary easing in a coordinated response from central banks across the world”

This vote is being felt around the world the effects are rippling both economically and consciously although the effects may be felt in the pockets, this is a huge victory for Britain.

Stocks and currencies are plummeting Global as investors are scrambling World wide.

Janet Yellen the Fed Chair woman WARNED of “Significant repercussions if Britain voted to leave.”

She has also warned that the Fed is running low on options to handle another economic crisis.

The Yuan dropped 7%

The Dow is projected to drop more than 700 points at the opening bell at the NYSE at 9:30 a.m. this morning with U.S. Future’s implying that both the S&P 500 and Nasdaq will be down by 5%

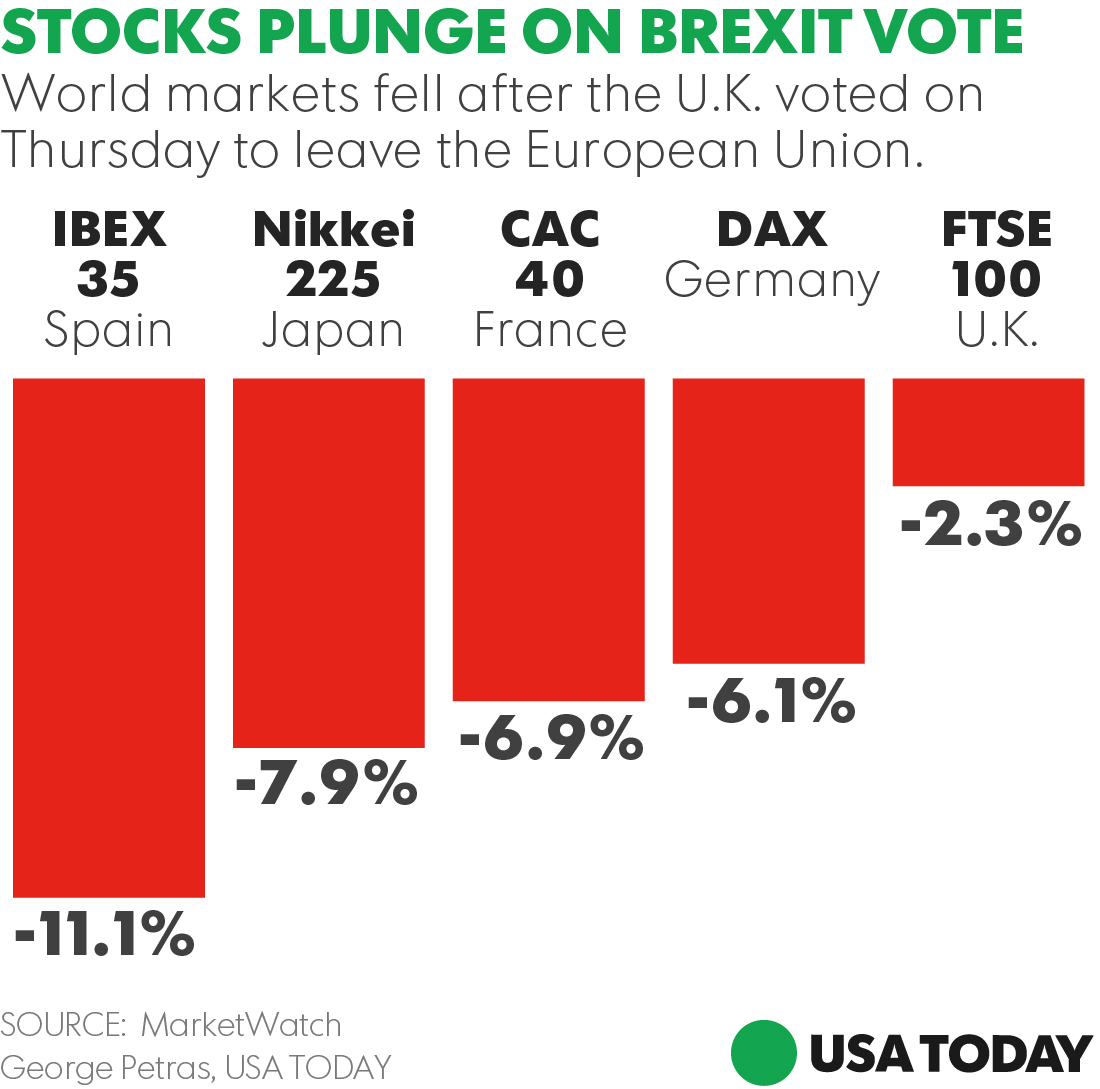

Asia stocks fell Nikkei Stock 1,200 points or 8%

Hong Kong’s Hang Seng 975 points or 5%

South Korea’s Kospi sank 4.2%.

Other Asian markets were also down 1-4%.

India’s Sensex index fell 3% and is continuing to plummet further.

That's what half a trillion dollars in losses looks like.

99% of AsiaPac stocks down #Brexithttps://t.co/zj7rM7TEJ3 pic.twitter.com/O3bZa4I8By— David Ingles (@DavidInglesTV) June 24, 2016

12 P.M. –

Bond Markets are feeling Britain’s exit from the European Union too.

ET -2.2%

The S&P 500 -2.4%

Nasdaq -2.8%

Bank stocks like JPM, Barclays, BOA are being hit by the Financial earthquake as well.

“You’re going to have a lot of political uncertainty, and that’s going to lead to financial uncertainty. And also, there’s an economic hit coming because you’re changing institutional relationships.” said Allianz Chief Economic Adviser Mohamed El-Erian of to CNBC.

EX FED CHAIRMAN Aalan Greenspan had this to say to CNBC.

“This is the worst period, I recall since I’ve been in public service. There’s nothing like it, including the crisis — remember October 19th, 1987, when the Dow went down by a record amount 23 percent? That I thought was the bottom of all potential problems. This has a corrosive effect that will not go away.”

Here's What Credit Markets Experts Are Saying About Brexit https://t.co/Ex25IN0fpM pic.twitter.com/Cfz9jBDbTU

— Bloomberg Markets (@markets) June 24, 2016

http://www.cnbc.com/2016/06/23/live-margets-edgy-as-voting-closes-in-historic-eu-referendum.html

The NYSE, Closed down Friday with the DOW down more than 600 points the worst day in history since August 2011.

Global Equity loss (S&P) broke a record hitting $2 Trillion Dollars lost to the Brexit Earthquake on Friday surpassing the Lehman Brothers 2008 Collapse and 1987 Black Monday Stock Market Crash. That’s $3,300 per every American’s 401K’s wiped out.

This blog will continue to be updated as fallout ensues.

Monday:

As Zerohedge and Tyler Durden have reported there are already signs that today’s open at 9:30 may be a repeat or worse of what we saw on Friday.

Markets in Europe are still feeling aftershocks Monday morning with the Stoxx Europe Banks stocking sliding -6.5& and other banks sliding 7% – 15% .

Royal Bank of Scotland -15%

Barclays PLC -14.8%

Lloyds Banking Group -9.2%.

George Osbourne the

UK treasury chief is already urging a calm after the storm that was Brexit.

DOW PLUNGES -200 POINTS AT OPEN.

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.