The bailout floodgates are open and the US taxpayer is footing the bill once again – whether through IMF loans or more directly. Today saw Ukraine issue $1 Billion 5-Year Notes at a stunningly low risk of only 28bps above US Treasuries and dramatically cheaper than the cost of capital in the public markets (and from the IMF) which yield over 10%. The reason for the 1) low cost, and 2) actual ability to raise debt… the bond is guaranteed by the US Agency for International Development and “assures full repayment of principal and interest” based on the full faith and credit of the US (Taxpayer). We assume Gazprom will be happy…

*UKRAINE $1B 5Y NOTES LAUNCH AT +28

So why not pile into these bonds? 28 extra basis points for no apparent additional credit risk… some liquidity risk but we are sure your friendly local central bank will enable you to swap them for infinitely rehypothecatable cash with no haircut…

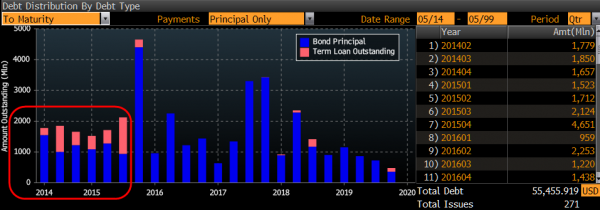

They’re gonna need moar… (and this does not include Gazprom)

Sign up on lukeunfiltered.com or to check out our store on thebestpoliticalshirts.com.